This is how you account your Google AdSense money

How to record revenue from Adsense? Want to get a quick answer with practical examples without having to spend time yourself and dig into why you must do exactly as I say in the example?

-Go Directly to the final title of this article, “The posting of Adsense revenue – This is how to do it!” and feed it in line by line into your accounting software and make your auditor and the tax authorities pleased.

Want to learn more about how you post sales of services within the EU?

Or do you want to get a more in-depth understanding of why you post as I show in the example? Follow this short education on EU sales and accounting with a focus on AdSense revenue.

Have you received money from Adsense?

There are many people out there who wonder how to record revenue from Adsense. It’s not that easy because a lot of you think that ordinary VAT is hard to understand, and it’s still just a breeze compared to the EU VAT and handling of purchases and sales of goods and services within the European Union.

Advertising revenue from Adsense is a sale

As soon as you have AdSense ads on your website or blog that generate income, it will be paid out monthly from Google in Ireland (if your company is registered within the EU). For US sole proprietorships, which you will receive domestic money from AdSense in the USA, which means you should post this revenue as a domestic sale instead. When you post the Adsense payment to your bank account, then you should post this as a sale of service within the EU that generated money to you and your company.

Even if you earn money from advertising and traffic FROM AROUND THE WORLD, it still counts as a single sale from your, for example, Swedish company to Google Adsense in Ireland. You will then need to post it as a “sales of services to other EU country“. You can add the revenue to a profit account labeled “Sales of Services EU” or something similar. Most accounting software and online accounting systems like Speedledger have this type of account already set up for use. But you may also want to create a completely new account called “Adsense revenue” to keep a more detailed track of all your revenue streams.

You will invoice Google Adsense in Ireland, which means: Reverse Charge

Reverse charge implies that it is the buyer and not the seller who report and pay sales tax to the state. Because you are receiving income from Adsense advertising, you are counted as a seller, and thus invoicing Google Adsense in Ireland will be a sale of services within the EU. The general rule applies, and therefore reverse charge applies, which means that Adsense in Ireland, in accordance with Article 196 of Council Directive 2006/112/EC, therefore, must account for VAT in Ireland and pay VAT to the Irish State.

Things to consider when creating an invoice to a customer in another EU country

When you sell a service to a customer in another EU country, you must state why you don’t put any domestic VAT on the invoice. In other words, if you are German with a German company, you must tell the receiver why you are not applying German VAT on the invoice to, for example, Google Adsense. This shall be indicated somewhere on the invoice e.g., on the bottom half. You motivate why you invoice without VAT with this quote:

“General rule for services, article 44 and 196 Council Directive 2006/112 / EC.”

Remember to enter the buyer’s VAT number on the invoice!

You usually do not add VAT on the invoice when you invoice a buyer with VAT number in another EU country. When it comes to AdSense, they will not send you a bill which is then paid, but rather Google Adsense simply sends the payment to you automatically. You don’t need to create an invoice to Google in Ireland yourself, they have already created self-billing invoices, and you can use the statement you can download from within AdSense as documentation for your accounting.

The posting of Adsense revenue – This is how to do it!

A simple example of how you post AdSense revenue from Google Adsense in Irland to your income statement or Profit & Loss as they say in the UK. Revenue accounts often start with a “4” in most international P&L setups (UK/US) but may vary depending on country and company type. In Sweden, revenue from sales accounts starts with a “3”. If you have a simplified Chart of Accounts with 3 digits, it could even start on “6”. You could also have Owner’s Equity on “3” (Owner’s Equity, Owner’s Investment and Owner’s Draw), and then revenue accounts start on “4”. Balance accounts typically start with a “1” or “2”. You may have 3 or 4-digit accounts, but 5 & 6-digits are also common. In this example, I am using the Swedish account system “BAS” which has a 4-digit representation of the accounts. Often you also need to specify a VAT-code, this should reflect this type of trade and additionally be labeled Sales of services to other EU-country or similar.

| Description | Account | Debit | Credit | ||

| Sales of services to other EU country | 3308 | 1000 | |||

| Business bank account | 1930 | 1000 | |||

If you are using the accounting software Speedledger, the revenue account 3048 “Sales of services to other EU-country”, is already set up for this purpose. The VAT-code for this in Speedledger is 390.

See an example of how you report this trade in the Swedish VAT return

(Don’t forget to report the AdSense sales in the EC-list reporting)

Where do you find the payment receipt for AdSense payments?

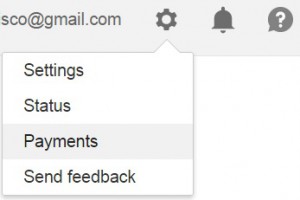

When you post the revenue from Adsense, you may be wondering what supporting documentation you should use. Actually, this is a sale to a company in another EU country, but you have not created and sent an invoice which you can book. What you can do instead is to download the receipt of payment from Google in Ireland and use it as a supporting doc. You can create a manual invoice in Excel if you want to ensure that there are proper invoices for all sales of the company. But the proof of payment from Google Adsense should be enough for most proprietorships regardless of country. You do have immediate access to extensive supporting documentation online in your Adsense account. Furthermore, Google is the company that initiates the payment and determines the amount, which really makes them responsible for generating valid self-billing invoices. Click on the gear icon at the top right and then click “Payments”:

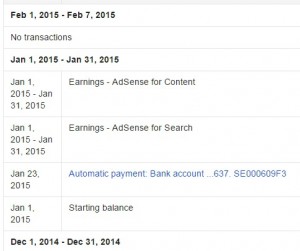

Then you click on the latest month and the verification doc in blue. It looks like this:

Then you get a picture of a voucher with the payment where Google’s VAT number is listed and a specification of the amount you can reconcile with the bank account. In this way, you have two different sources that allow you to follow generally accepted accounting practices, which state that you need at least two separate proof of a transaction to comply with Tax and Accounting rules and regulations.

How do you turn on first-party cookies in Google Adsense to make more money?

Keywords: Record Adsense revenue, Google, Ireland, Adsense revenue, Google Adsense, EU-VAT, How to post AdSense revenue in your accounting software.

I am VAT registered and I am required to periodically fill a

VAT recapitulative statement, with the sales to EU companies (in this case Google Ireland) listing their VAT. According to my accountant the buyer

of services has to also report the same matching transaction using my VAT ID. Unfortunately there is no way to provide my VAT ID so this transaction is

not reported from Adsense in a VAT recapitulative statement.

Many people start as a hobbyist with an Adsense account, then they become a real business but are still a “consumer” in the Adsense system, hence no need for them (Google) to get your VAT-number. The grocery store doesn’t ask their customers for their VAT-number you know 🙂

You cannot move or transfer an Adsense account. You will need to get a new one as your business, then you can register with VAT-id, but you will need to replace all the codes on your sites..

if you are a blogger with many old sites without sitewide code boxes, you are in for an administrative nightmare of epic scale 😉

YOU still need to report the sales amount per VAT-id (Googles VAT number here: IE6388047V) in the periodic reporting. Adsense should report this too when they know you are a business, but since they force people to remain registered as “consumers” their policy gives them a loophole.

This generates, as you stated, a discrepancy for the EU-VAT system as a whole. You have probably heard by know of many billions of VAT EU thinks it is being cheated by from organised criminal organisations; however, my opinion is that significant amounts of the “black hole” comes from setups like this by legal and law-abiding businesses.

The EU-VAT system is flawed in many ways, and the proposed reforms will only make the nightmare worse for small companies, despite EU bureaucrats constant speeches about how much easier and better they are making the EU for small businesses all the time. A lot of crap I would say, and the sad thing is the many in the EU-parliament has no clue about the mess they are generating.

But back to your case, as long as YOU report YOUR amount you have your back covered. Let Google handle their side of the problem when the EU-bureaucrats wake up and force Google to close this loophole.