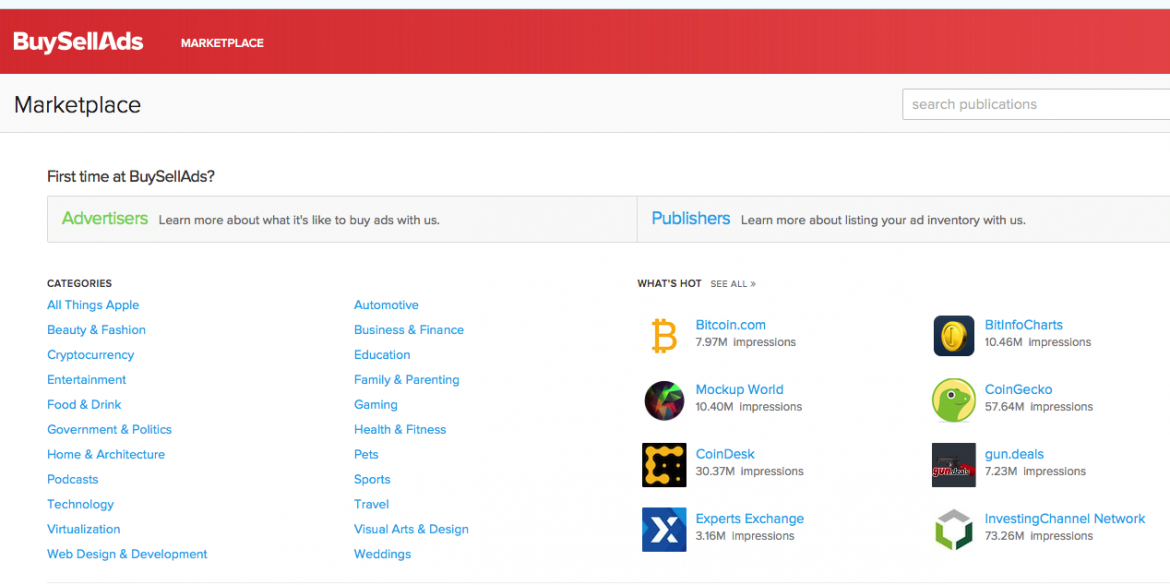

Many people use Google Adwords, Bingads and Facebook Ads to promote their website, their product or service , but there are many other great and good services to advertise on the internet. Such a service that many people use is BuySellAds.com where they can focus their advertising very precisely on certain specific websites, it is even possible to select the exact position and region you want your ads to appear on for different pages and websites. But how do you post advertising expenditure that you buy from sites like this? Since BuySellAds is based in the US, this becomes an import of services outside the EU (if your comapny resides in a EU country that is). If you are an American company this will naturally be a normal domestic transaction. If you are based in the EU you will also have to self-asses VAT on this kind of purchase. This is because the tax authorities wants to know the turnover of imported services and you need to specify a calculated VAT based on the VAT rate in your own country. It will also need to be reported in your VAT return in one way or another. But the VAT forms are very different even between EU countries. Italy has like 500 different boxes to fill in while Ireland and UK only specify a handful of squares to be filled in. Normally you will find a suitable cost account to book Advertising expense on accounts starting with 5 or 6 in your chart of accounts. Digits and exact interval differs between countries but the general division into account series are pretty much the same. As an example this cost could be booked on account 5910 Advertising in Sweden and its 4-digit account system. Here is a practical example of how to post BuySellAds advertising expense:

| Description | Account | Debit | Credit | ||

| BuySellAds.com (USA) | 5910 | 1000 | |||

| Output VAT services to foreign country | 2614 | 250 | |||

| Input VAT purchase of services from another country | 2645 | 250 | |||

| Owner’s investment | 2018 | 1000 | |||

Often you buy these kinds of services with your credit card, and if you are a sole proprietor, often with your private credit card. To make this count in your business you must book this as an owner’s investment, which will increase the company’s debt to you as an owner. You are lending your private money from your private credit card to your company. The specific account for owner’s investment will be different depending on your country and accounting software. But usually you will find it starting with “2” or “3”.