VAT Calculator. How do you calculate VAT backwards? Where can I find Reverse VAT calculator? How to back-calculate VAT? If I know the price in the store how do I calculate the price without VAT? Need a formula for excluding sales tax from the gross sum? Can I calculate VAT backward online?

THE BACKWARD-VAT CALCULATOR:

This is how you usually calculate VAT backwards manually:

25% VAT: calculate 20% of the price (1/5)

12% VAT: calculate 10,71% of the price (1/9,3371)

6% VAT: calculate 5,66% of the price (1/17,6678)

Calculate backwards VAT

Suppose the net price (without) VAT is $100. With 25% VAT, the price becomes 125. We can then either divide or multiply to reach the value or amount we are seeking.

Bookmark this page so you can find the reverse VAT calculator again!

Backward VAT for 25%

Assume price with VAT = 125

Calculate price excluding 25% VAT: 125 x 0,8 = 100

or 125 / 1,25 = 100

VAT amount at 25% VAT-rate: 125 x 0,2 = 25 Kr

or 125 / 5 = 25 Kr

Reverse VAT value for X%

Sometimes you need to calculate the prices without the usual VAT rates in your country. You might be working in the UK but you also have an office in the Netherlands which you operate from London. Or maybe you are running the show for several territories and need a fast calculator that can find the price without VAT or sales tax or GST or whatever it is called in each particular country. Then you need a VAT calculator which can handle any given VAT rate, not just the domestic ones. If we should calculate with an arbitrary rate of VAT, then we can’t use predefined multiplication or division numbers. To be able to count with a general VAT rate “X”, we have to solve an equation. As an example, I will use the UK standard VAT rate of 20%.

Assume price incl. VAT = 120 Kr, X = 20.

Calculate price without X% VAT: 120 / (1 + (X/100)) =

120 / (1 + (20/100)) =

120 / (1 + (0,20) =

120 / (1,20) = 100 Kr

VAT value at X% VAT: 120 – 100 = 20 Kr

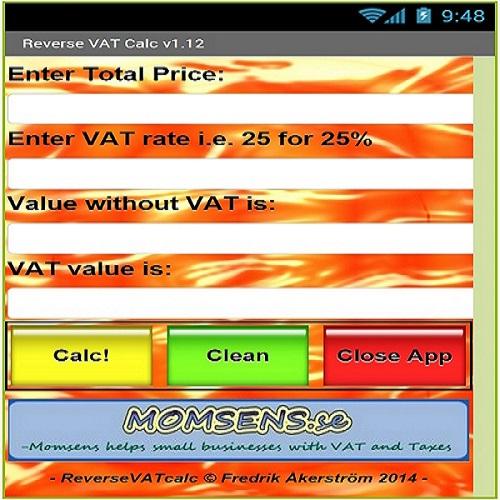

Are there any mobile apps to calculate VAT backwards?

Yes, I have created VAT calculators for both iOS och Android. You can download the VAT calculators for your mobile phone for free to enable you to swiftly calculate the price without VAT for any price and any VAT-rate. The Sales tax apps work on both iPhone, iPad, iPod and Android-based devices like tablets and pads.

Backward VAT calculator app:

Mobile app for calculating VAT backwards (reverse VAT calculator)

Android app is created in App Inventor.

Universal VAT calculator on App Store (for iOS iPhone/iPad units) is located here:

iPhone app was created in Xcode och programmed in Objective-C.

Calculate VAT backwards – find the price without VAT from the gross amount with this mobile app calculator.

Wonder which VAT rates other EU countries have?

VAT rates for all EU-countries

The Reverse VAT calculator

What will you learn on this page? How to take tax away from a price – that is what this page is about, purchase tax calculation help. With the online VAT calculator on this page, you will be able to de-tax a price so to speak. You can use this calculator to deduct VAT or to remove, extract or take away a percent (%) of sales tax from a price. You will also learn how to get down to a net price from a gross price. Or in other words, you will understand: How to deduct tax from a price which includes VAT.

if i have a vat amount only what is the excel formula to work out the net

Net amount = (VAT amount / VAT rate) * 100

where to check current vat rate of any specific country

These pages would be a great place to start. If you need freshly updated VAT rates for the whole world, I would suggest these solutions:

https://mr-eurodisco.com/finance/eu-vat-rates/

https://mr-eurodisco.com/finance/vat-rates-for-electronic-services-in-all-eu-countries/

This VAT rate service covers the whole world:

https://www.ey.com/en_gl/tax-guides/worldwide-vat–gst-and-sales-tax-guide-2020

VAT rates can change, so it might be worthwhile checking these are up to date before you use them: https://vatcalculator.com/vat-rates-around-the-world/

Net amount = (VAT amount / VAT rate) * 100

Great blog post, thanks for sharing.