Facebook Ads. Have you purchased ads on Facebook? Do you wonder how to post the cost of Facebook advertising? How do I record the cost of Facebook ads in my accounting software? Here you will find a practical example of how to account the cost and how to handle the VAT issues when buying Facebook ads.

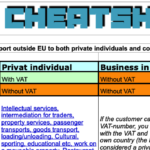

First, we have to find out in which country Facebook Ads is registered, for us to know if it becomes complicated EU VAT management in the accounting, or if it will be a pretty straightforward posting of a purchase of services outside the EU?

Not surprisingly the Facebook entity handling sales of Facebook ads in Europe is located in Ireland for the European market. This means that we purchase a service from a company in EU, which affects the VAT treatment and thus the accounting of this transaction. We must also find out Facebook’s VAT registration in Ireland (IE9692928F). You will find it on the invoices that can be downloaded by going to the “Ads Manager“, then click on the “Billing” in the left column, then click “Download as PDF” in the line. You can not list all the invoices but must check monthly. Internet advertising can be booked on the normal cost account “advertising” or similar, depending on your accounting software setup. Alternatively, you can post it to your account for the purchase of services within the EU. You can even create your own cost account in the ledger specifically for internet advertising if you do a lot of it and want to track costs better for this expense. In this example, I select a specific account for advertising to have better control of my advertising spending.

When you are buying ads from Facebook you are purchasing a service from Facebook in Ireland, just like when you are buying ads with Google Adwords, you are purchasing a service from a company registered in Irland. If your company is not registered in Ireland, we need to do a Self Assessment of the VAT rates for UK (reverse charge) and add two lines of VAT that cancel each other out. Depending on which accounting software you are using, you may also need to enter or select a VAT code that reflects that this is a purchase from a company within the European Union when you record this cost.

How to record the cost of Facebook ads

In this example, I post the payment against “Owner’s investment” account since I assume we paid with our private credit card, but the cost belongs to our sole proprietorship. Usually, you can find a suitable cost account for advertising expenses on accounts starting with 5 or 6 in your chart of accounts. The Output and Input VAT accounts will be different depending on your country of registration and your accounting software. In this accounting example, I use the Swedish BAS-system for the accounts.

| Description | Account | Debit | Credit | ||

| Facebook Ads (Irland) / Advertising cost account | 5910 | 1000 | |||

| Output VAT services to foreign country | 2614 | 250 | |||

| Input VAT purchase of services from another country | 2645 | 250 | |||

| Owner’s investment | 2018 | 1000 | |||

Read Facebook FAQ about VAT on advertising purchases