VAT rates in EU countries. What is the VAT rate in the UK? How much sales tax is applied in France? Where do I find VAT rates for an EU country? How much is the VAT in 2017? VAT in Europe? Where can you find EU VAT rates for all member countries?

Many businesses and organisations need to know the VAT rates in other EU countries for bookkeeping and accounting or just for information purposes. However they can be hard to track down, and it could be difficult to find an updated list of EU VAT rates because they change all the time.

The minimum rate for VAT in the EU is 15% for the standard rate. The minimum VAT rate for the reduced rate is 5%, but not all countries follow this policy (France, Italy, Ireland, Austria, Luxembourg, and Spain).

EU VAT RATES

Officially EU only allows two separate reduced VAT rates, but that is obeyed neither by France, Italy, Ireland, Austria nor Luxembourg. Several countries have an extra VAT tariff for parking fees and some other stuff. Luxembourg is undoubtedly the black sheep when it comes to VAT and Taxes in the EU. Arising from a specialisation as Tax heaven, this is understandable, but also illustrates the madness of trying to have a common market with so many different VAT and TAX systems. However, Luxembourg has started to conform better today, especially after abolishing the super-reduced rate of 3% for digital services.

VAT rate in each EU country

| LAND | VAT | R1 | R2 | Rx | Term | Description | ||

| 21% | 6% | – | 12% | BTW | Belasting over de toegevoegde waarde | ||

| TVA | Taxe sur la Valeur Ajoutée | |||||||

| MWSt | Mehrwertsteuer | |||||||

| 20% | 9% | 5% | – | ДДС | Данък върху добавената стойност | ||

| 19% | 9% | 5% | 3% | ΦΠΑ | Φόρος Προστιθέμενης Αξίας | ||

| 25% | – | – | – | moms | Meromsætningsafgift | ||

| 22% | 9% | – | – | km | Käibemaks | ||

| 24% | 14% | 10% | – | alv | Arvonlisävero | ||

| moms | mervärdesskatt | |||||||

| 20% | 10% | 5.50% | 2.10% | TVA | Taxe sur la Valeur Ajoutée | ||

| 24% | 13% | 6% | – | ΦΠΑ | Φόρος Προστιθέμενης Αξίας | ||

| (16%) | (9%) | (5%) | ||||||

| 23% | 13.50% | 4.80% | 9% | VAT | Value Added Tax (engelsk) | ||

| CBL | Cáin Bhreisluacha (gaelisk) | |||||||

| 22% | 10% | 4% | 5% | IVA | Imposta sul Valore Aggiunto | ||

| Croatia | 25% | 13% | 5% | PDV | Porez na dodanu vrijednost | |||

| 21% | 12% | 5% | – | PVN | Pievienotās vērtības nodoklis | ||

| 21% | 9% | 5% | – | PVM | Pridetines vertes mokestis | ||

| Luxembourg | 17% | 8% | 3% | 14% | TVA | Taxe sur la Valeur Ajoutée | ||

| 18% | 7% | 5% | 12% | VAT | Taxxa tal-Valur Mizjud | ||

| 21% | 9% | – | – | BTW | Belasting toegevoegde waarde | ||

| Netherlands | ||||||||

| COUNTRY | VAT | R1 | R2 | Rx | Term | Description | ||

| 23% | 8% | 5% | – | PTU | Podatek od towarów i uslug | ||

| VAT | ||||||||

| 23% | 13% | 6% | – | IVA | Imposto sobre o Valor Acrescentado | ||

| (Madeira:22%/12%/5%) (Azores:16%/9%/4%) | ||||||||

| Romania | 19% | 9% | 5% | – | TVA | Taxa pe valoarea adaugata | ||

| 20% | 10% | 5% | – | DPH | Dan z pridanej hodnoty | ||

| Slovenia | 22% | 9.50% | 5% | – | DDV | Davek na dodano vrednost | ||

| 21% | 10% | 4% | 0% | IVA | Impuesto sobre el valor añadido | ||

| IGIC | Impuesto General Indirecto Canario | |||||||

| 20% | 5% | – | – | VAT | Value Added Tax | ||

| United Kingdom | ||||||||

| 25% | 12% | 6% | – | moms | Mervärdesskatt | ||

| 21% | 12% | 0% | – | DPH | Dan z pridané hodnoty | ||

| 19% | 7% | – | – | MwSt | Mehrwertsteuer | ||

| USt. | /Umsatzsteuer | |||||||

| 27% | 18% | 5% | – | ÁFA | Általános forgalmi adó | ||

| 20% | 10% | 13% | 12%, 0% | USt. | Umsatzsteuer | ||

Table updated: 13 MAR 2024.

*1) The Canary Islands have 7% (6,5% 2019) but are not included in the EU VAT rates area

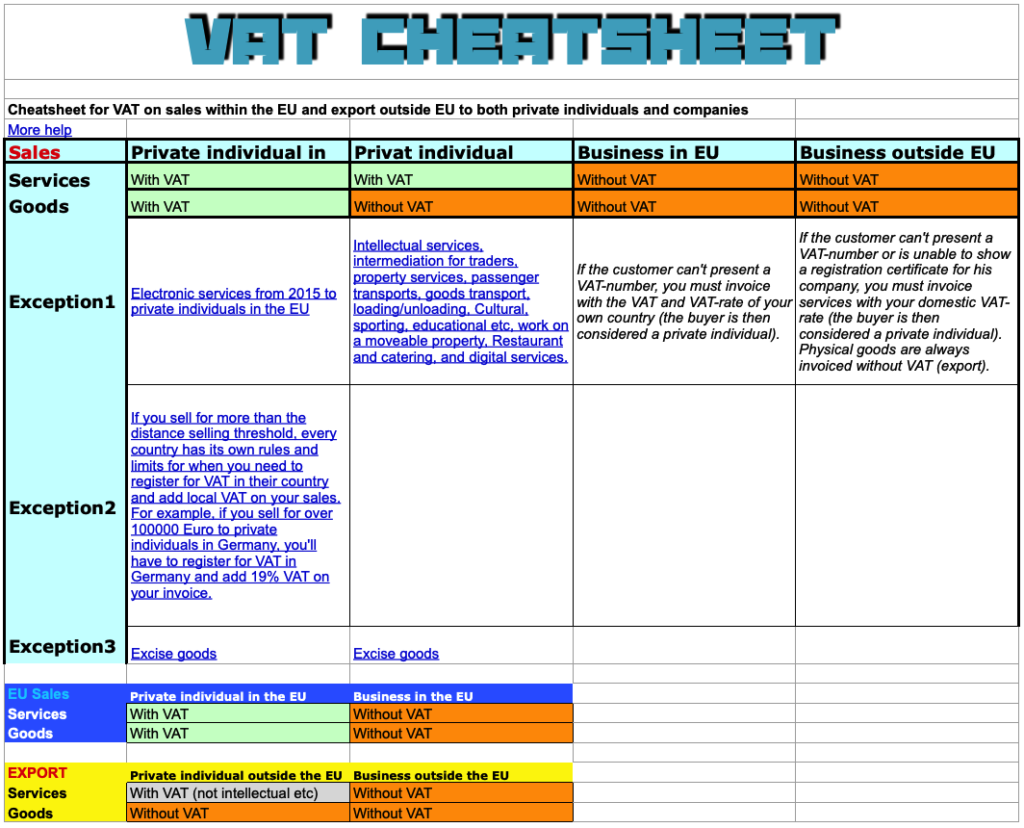

EU VAT Cheatsheet

Other articles about VAT that might be of interest to you:

VAT Changes in 2020

How do I check VAT numbers of foreign countries?

VAT rates in Sweden for electronic services

VAT payable (output VAT)

VAT reporting: Accrual method vs Cash method

VAT rates in Sweden

Sales tax

Pingback: BTW-gebied van de EU - Het BTW

Pingback: German VAT rates - Accounting & Finance blog

Pingback: EU VAT AREA - Accounting & Finance blog

Pingback: Thresholds for distance selling in EU - Accounting & Finance blog

Pingback: UK VAT Rate - Accounting & Finance blog