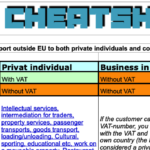

VAT payable is also called output VAT and is found on invoices you are sending to the customer. Or in other words output VAT is found on invoices going out from your company. When you sell something to a customer and send a bill to them in the form of an invoice you are also, usually, applying output VAT on the service or product (some exceptions exists for VAT exempt items and services in UK). The output VAT should be paid to the tax authorities each period which is why it is called VAT payable. The Output VAT is deducted with the amount of Input VAT you have any given period. The difference (output-input) becomes your liability to the tax office. This is the amount you will need to pay to the tax authorities. Companies that sell more than they purchase for will always have a surplus of output VAT.

What is Output VAT?

It’s the same as VAT payable.

Pingback: EU VAT rates - Accounting & Finance blog

The best definition I have ever found describing Output and Input VAT. I never got the concept in School.

Good defination