Check VAT number of EU companies

VAT number lookup. Where can I check VAT numbers of my customers and suppliers? How do you know it you invoice a valid and active VAT number for a European company within the EU VAT area?

If you are situated within EU and buy or sell to companies in other EU countries, you will be glad to hear that there is already a suitable tool available for you which will enable you to verify any VAT number within EU.

Verify EU-VAT number

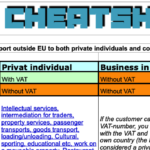

When invoicing without VAT to another company within the EU, you will need a valid EU VAT number from the customer and print it on the invoice. If, as an example, your French customer does not have a valid VAT-number, you will need to assume it is a private person and apply VAT on the invoice. Therefore it is important to check the EU VAT number.

How do you verify several VAT-numbers at the same time?

It took a while, but in the end, an entrepreneur had enough and created their own service for checking multiple VAT numbers at once.

Check multiple VAT numbers at the same time here!

EU VAT numbers

The VAT numbers start with two letters indicating the country of origin, i.e. FR for FRANCE. The number of digits varies from country to country and can even end with a letter like “Z”. But they always start with the 2-letter country code that is the same two letters that are used for country-specific domain names like alvtieto.FI for a Finnish website, momsviden.DK for a danish, dermwst.DE for a German or momsens.SE for a Swedish site.

Pingback: EU VAT rates - Accounting & Finance blog

Pingback: UK VAT Rate - Accounting & Finance blog