Fill out W-8BEN-E. What is W-8BEN? How do I fill out the IRS W-8 document? What fields must be completed on the W-8BEN-E form? What is W8BENE?

“Hey! Do you know if you need to fill out Form W-8BEN or W8BEN-E if you have a sole proprietorship? (applies to DistroKid registration)”

Do you need to fill out the W-8BEN-E?

Individuals and sole proprietorships must formally file W-8BEN even if they are not claiming a tax credit. If it’s missing, 30% withholding tax will be withheld. Form W-8BEN-E does not need to be completed by companies that do not claim a tax credit. DistroKid has an instruction page here with help on how to fill out the form. It is the responsibility of the paying company to collect this form. It should not be sent to the US Internal Revenue Service, but the company paying you simply needs to have this document archived – if you want to avoid 30% additional tax. The W-8BEN(-E) form also clearly states that it must not be filed with the IRS – either by you receiving the money or the entity paying it. The auditors of the paying company want to see this document to check whether they are allowed to pay compensation to a person without deducting 30% tax. If this document is present, the company can avoid paying taxes on the money and the tax rate is set to 0% (or in some cases 15%). If it’s missing, the company must deduct 30% tax from the payment. This tax is called withholding tax.

For individuals/companies registered in a country that has a double taxation treaty with the US, and where the payer has collected Form W-8BEN(-E), this withholding tax is reduced to 0% (15% in some cases). See if your country has this here.

Terminology explanation:

W-8BEN-E: For companies (E stands for “Entities”).

W-8BEN: For private individuals/hobby businesses/sole traders/sole proprietorships.

W-8: All forms beginning with W-8 refer to the certification of withholding tax and tax residency.

W-9: For US citizens only (equivalent to W-8BEN-E for foreign residents).

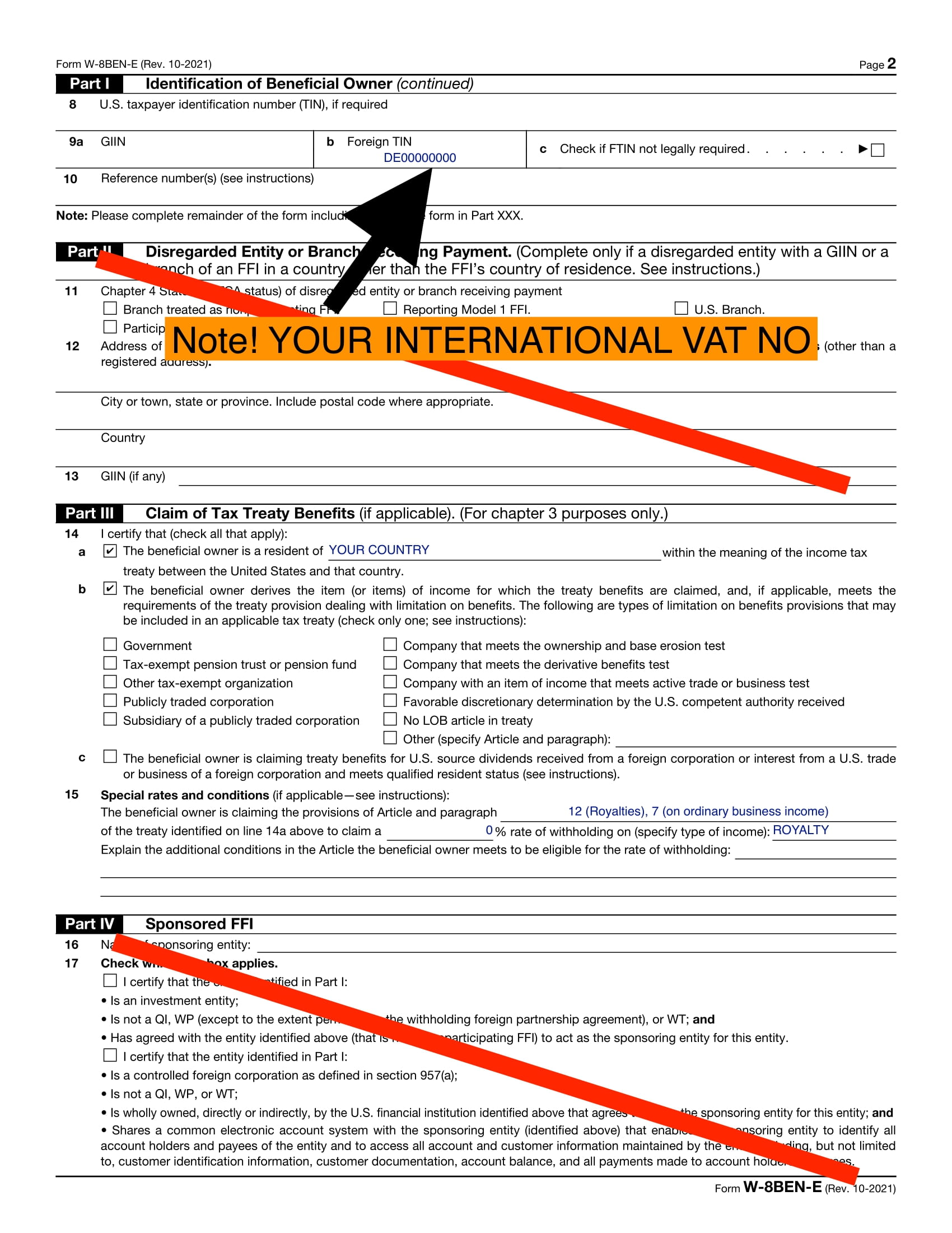

Foreign tax identifying number: Your INTERNATIONAL-VAT-no (i.e. VAT identification number DEXXXXXXXX).

Withholding tax: Tax deduction (comparable to employer contributions deducted before the employee receives the money).

FATCA: Foreign Account Tax Compliance Act (FATCA), enacted as part of the HIRE Act, requires foreign financial institutions and certain other foreign non-financial entities generally, to report foreign assets held by their US account holders or be subject to a withholding tax on payments subject to withholding tax. The HIRE Act also contained legislation requiring US persons to report their foreign financial accounts and foreign assets by value.

FFI: Foreign Financial Institute. If this concerns you, you would have known about it. sole trader companies have nothing to worry about on any row marked with FFI.

Should I fill out W-8BEN or W-8BEN-E?

If you are an individual, author, artist or hobbyist and receive the money/royalty as a private individual, I strongly recommend that you complete the W-8BEN as it only has one page. Even if you have a sole proprietorship and a VAT number, you can still receive royalties as an individual. According to University of Oregon, Sole Traders are also interpreted as “private individual” in this case. If this is the case, use W-8BEN. If it is clear that your company (Ltd/shareholding company) is receiving the royalties and not you as an individual or your sole proprietorship, then you should use the form with E at the end. The E stands for Entity and refers to companies and organisations. The business form W-8BEN-E is 8 pages long and MUCH more complicated to understand. It is a textbook example of bureaucracy gone haywire, and if you ask me, it should be illegal for states to subject entrepreneurs to this kind of bureaucratic terrorism because let’s face it – that is what it really is.

The fact that the form also states that it has been reviewed under the Paperwork Reduction Act makes it even more laughable. Under this Act, for example, this is to be avoided:

- We want to be good stewards of the public’s time, and not overwhelm them with unnecessary or duplicative requests for information.

- The PRA clearance process involves calculating burden hours. It’s important to understand how long it will take members of the public to complete your request.

Anyway, most of the sections can be skipped by a small business or Ltd, but it can be difficult to know what to fill in and how to fill it in.

For most small businesses, it is sufficient to complete Part I and Part III as well as Part XXX with a signature.

A Sole proprietorship should fill out W-8BEN.

Why is W-8BEN(-E) needed?

It is required to prove where you are registered for tax and to ensure that you are not a US citizen. Then you will avoid the higher tax of 30%. The form is valid for 3 years, after which it must be renewed. Some companies which pay you may have an internal policy requirement to update this every year.

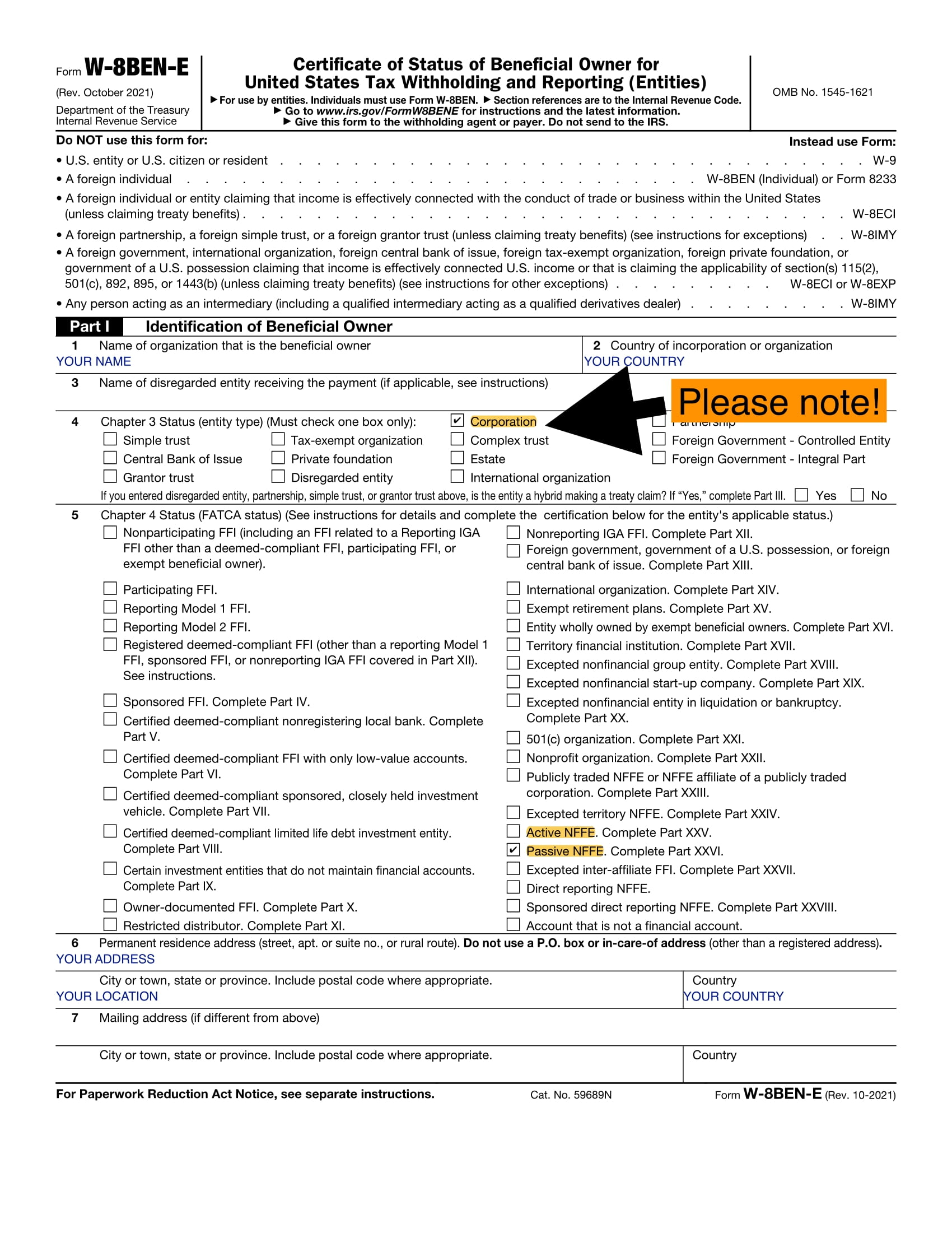

Example of a completed W-8BEN-E

W-8BEN-E (page 1)

Here (section 5) you need to fill in either Active NFFE or Passive NFFE. If you do, you must answer the follow-up questions in XXV or XXVI. If your payor requires “Chapter 4 status” to make payments, most small businesses should choose Active NFFE or possibly Passive NFFE. If your business consists mainly of commission income, e.g. from music, books or similar royalties, you should choose PASSIVE NFFE.

Active NFFE

A business is considered an active NFFE if it is a business and less than 50 per cent of its gross income in the preceding calendar or tax year consists of passive income. In addition, the weighted average of the percentage of assets held by the entity that generate passive income or are held to generate passive income (weighted by total assets and measured on a quarterly basis) is less than 50 per cent. The value of an NFFE’s assets is determined based on the market value or book value of the assets on the NFFE’s balance sheet (under a US or international accounting standard).

Passive NFFE

In general, passive income refers to the portion of gross income derived from dividends, interest, interest-like income, annuities, rent and royalty (other than rents and royalty received in the active conduct of a business or activities carried on at least partly by employees) and other passive types of income.

W-8BEN-E (page 2)

Part III – 14

14 b) Check the box at 14 b and then the box for “Company that meets the ownership and base erosion test“. This means that your company is more than 50% owned by a person (you) who is registered in the same country (e.g. UK) as your company (which is registered in UK). The main point here is to prevent people from a third country from trying to obtain benefits through another country (e.g. UK) that has a tax treaty with the US. It’s not entirely clear whether a person registered in the same country as the company really needs to fill out 14b, but I recommend doing it the way I suggested to be overly clear.

Part III – 15

There are contradictory statements if you have to justify on the lines below 15 when it says as it does in the form and instructions. However, when reading the IRS instructions for the form, this seems redundant. My interpretation is that you already justified this in 14(a) and therefore do not need to justify further on the lines in 15:

Line 15 must be used only if you are claiming treaty benefits that require that you meet conditions not covered by the representations you make on line 14 (or other certifications on the form). This line is generally not applicable to claiming treaty benefits under an interest or dividends (other than dividends subject to a preferential rate based on ownership) article of a treaty or other income article, unless such article requires additional representations. For example, certain treaties allow for a zero rate on dividends for certain qualified residents provided that additional requirements are met, such as ownership percentage, ownership period, and that the resident meet a combination of tests under an applicable LOB article.

https://www.irs.gov/instructions/iw8bene

BUT… what the instructions say and what practice looks like in reality seem to diverge on this point. The auditing firm KPMG has concluded that line 15 should nevertheless be completed:

“Complete Line 15 and indicate that the income is not attributable to a permanent establishment in the United States. Line 15 must be completed when the beneficial owner is claiming treaty benefits that require it to meet conditions not covered by the representations otherwise included on the Form W-8BEN-E. As the business profits treaty clauses require that the income for which the treaty claim is made is not attributable to a permanent establishment in the United States, the beneficial owner must certify to this on Line 15. While some may argue that this is not required, experience reveals—both from tax audits and based on discussions with IRS examination teams—that Line 15 must be completed.”

The most important thing is to highlight that your company has a permanent establishment in e.g. UK and that the company pays taxes in UK, for example.

“I work from the UK, and my company has a permanent establishment only in the UK, where the company pays taxes on its revenue.”

If you have ordinary business income, you can fill in the other fields under 15 as follows:

ARTICLE 7(1), 0, Business profits

W-8BEN-E (page 3)

W-8BEN-E (page 4)

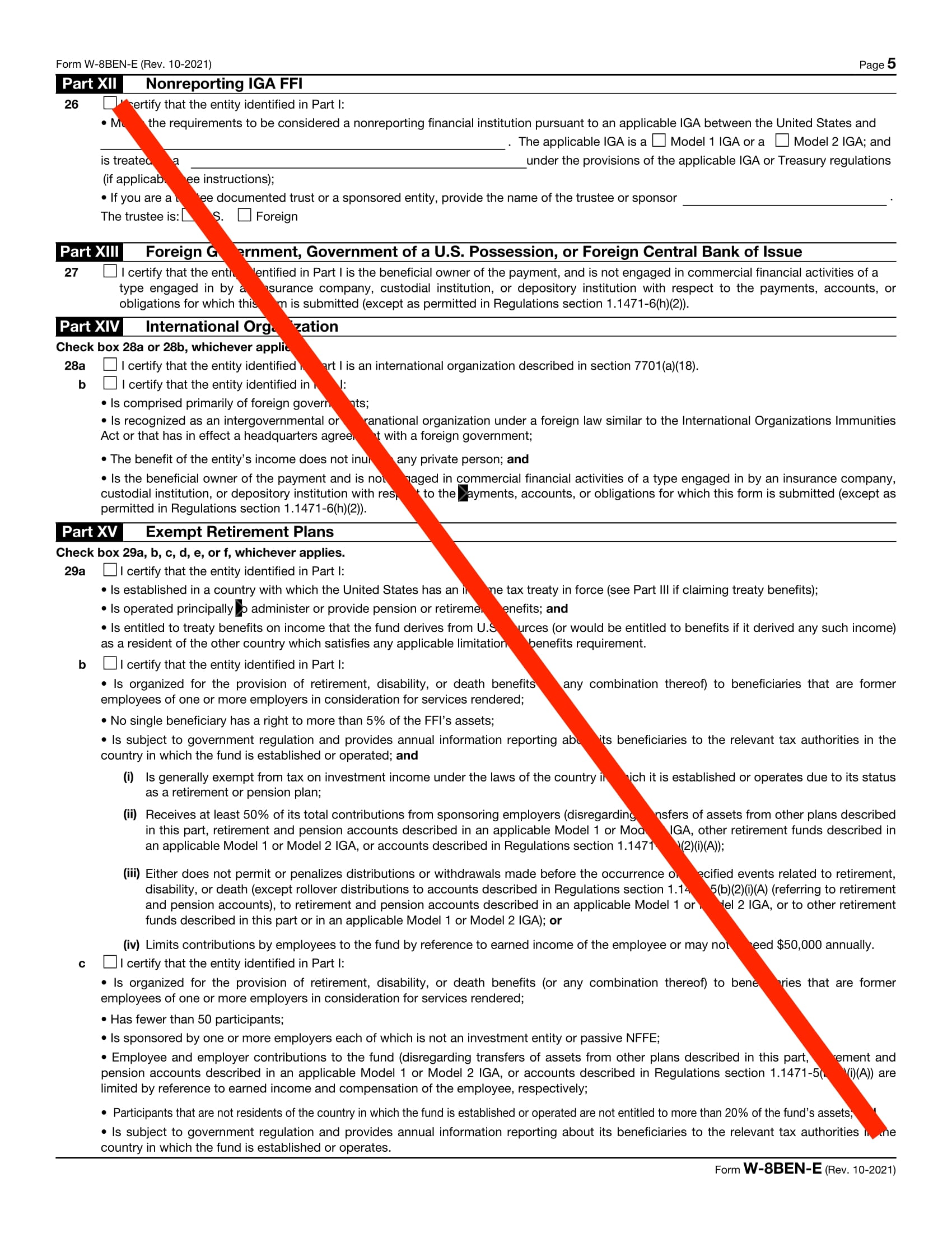

W-8BEN-E (page 5)

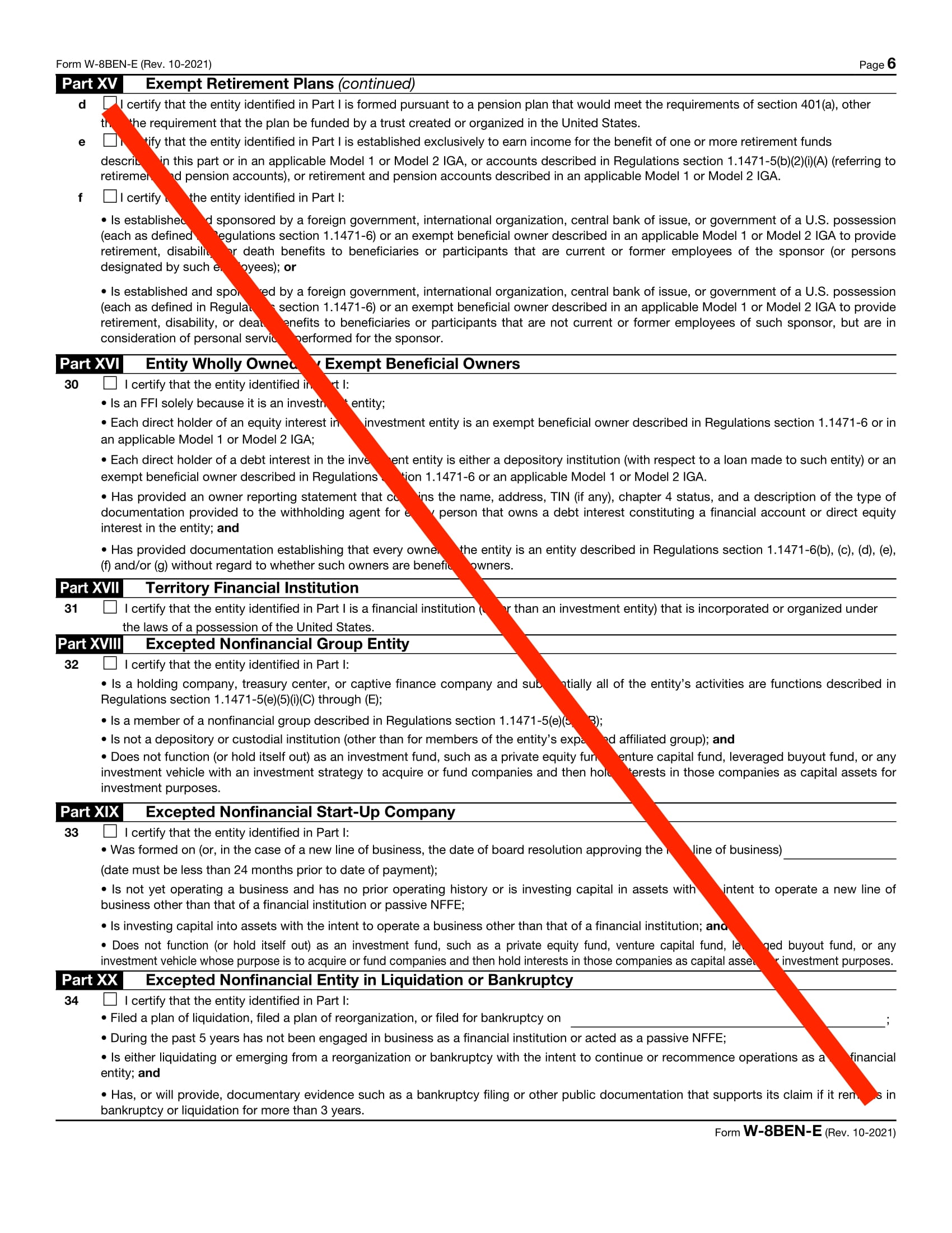

W-8BEN-E (page 6)

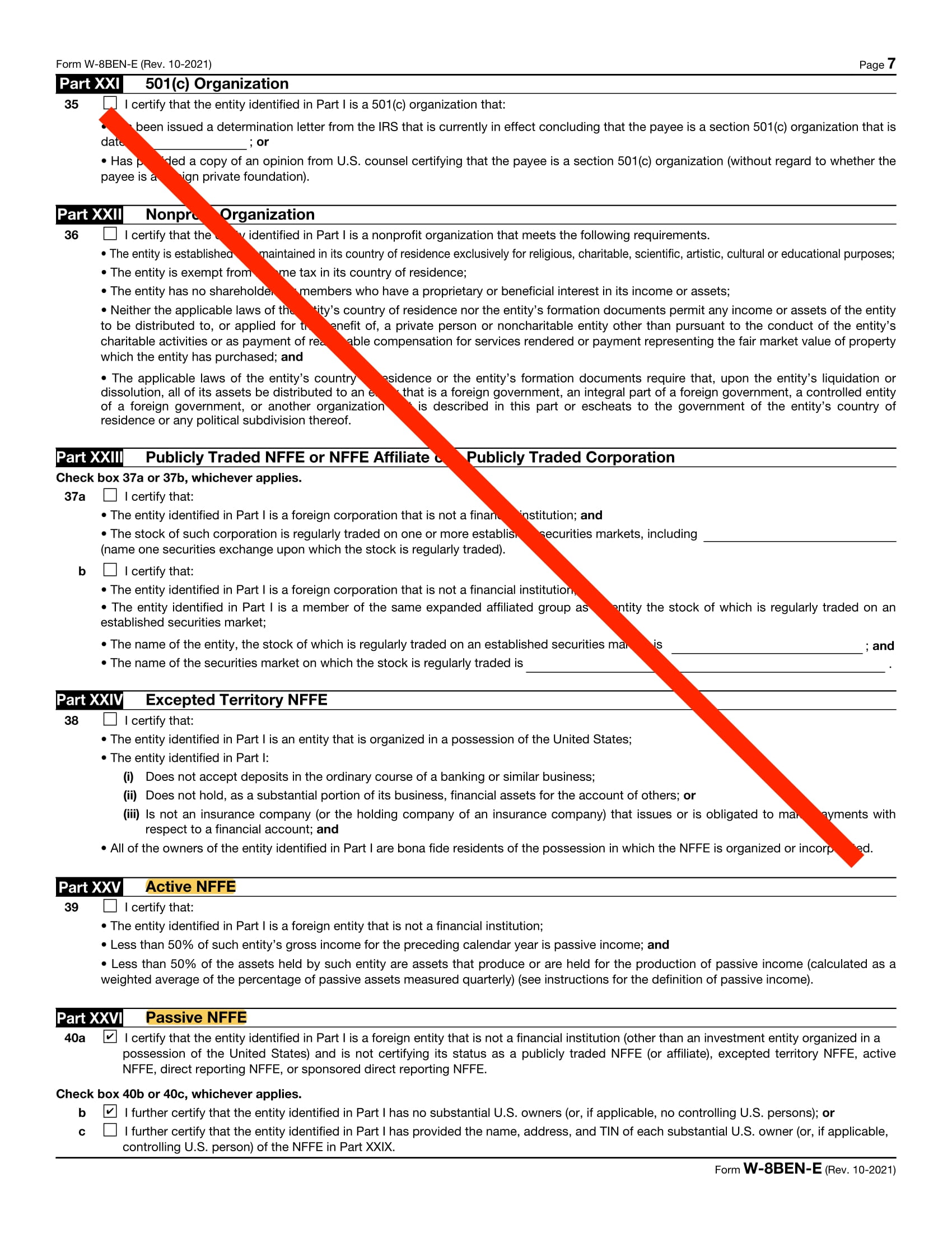

W-8BEN-E (page 7)

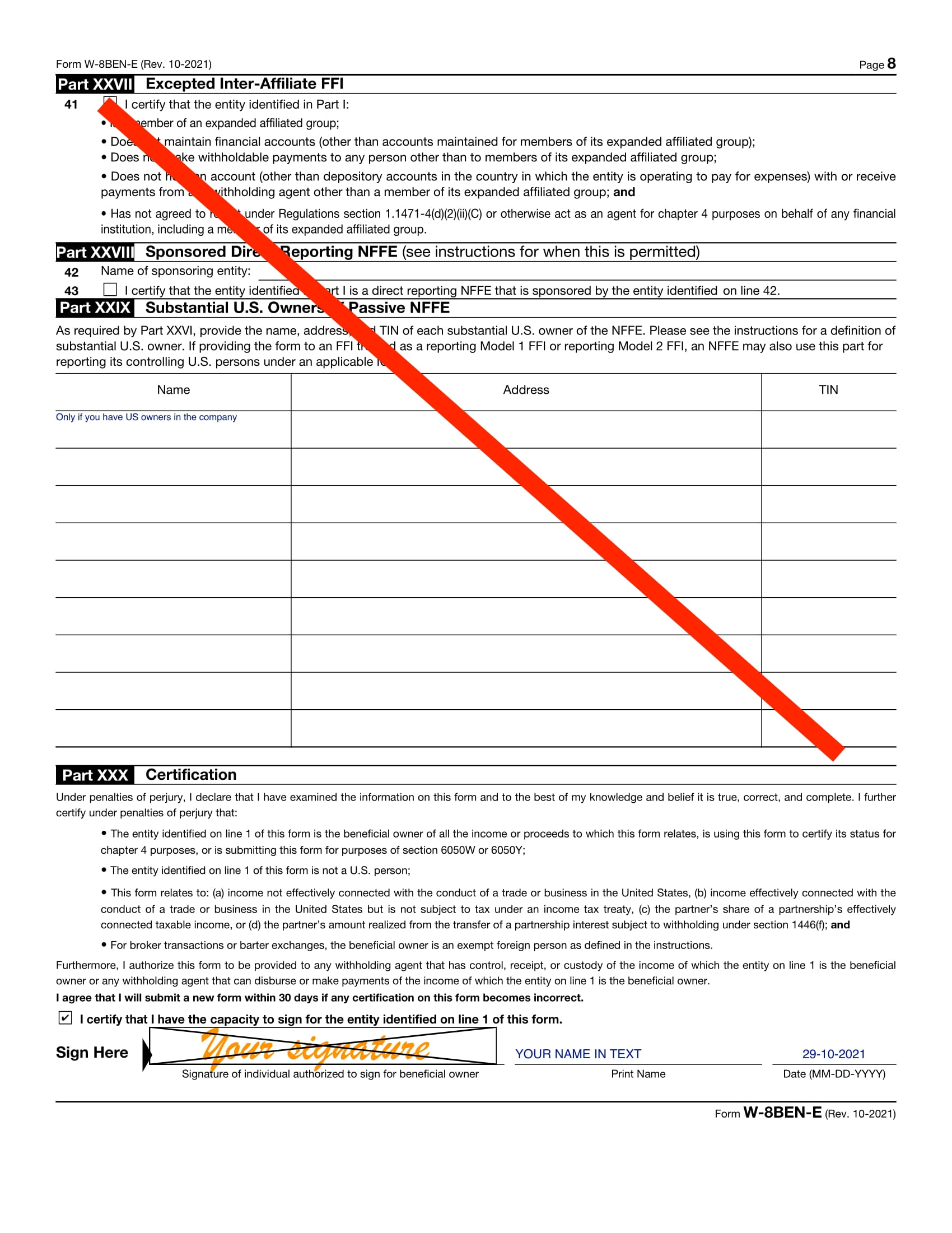

W-8BEN-E (page 8)

Download all the pages as one PDF doc of the completed sample W-8BEN-E form here

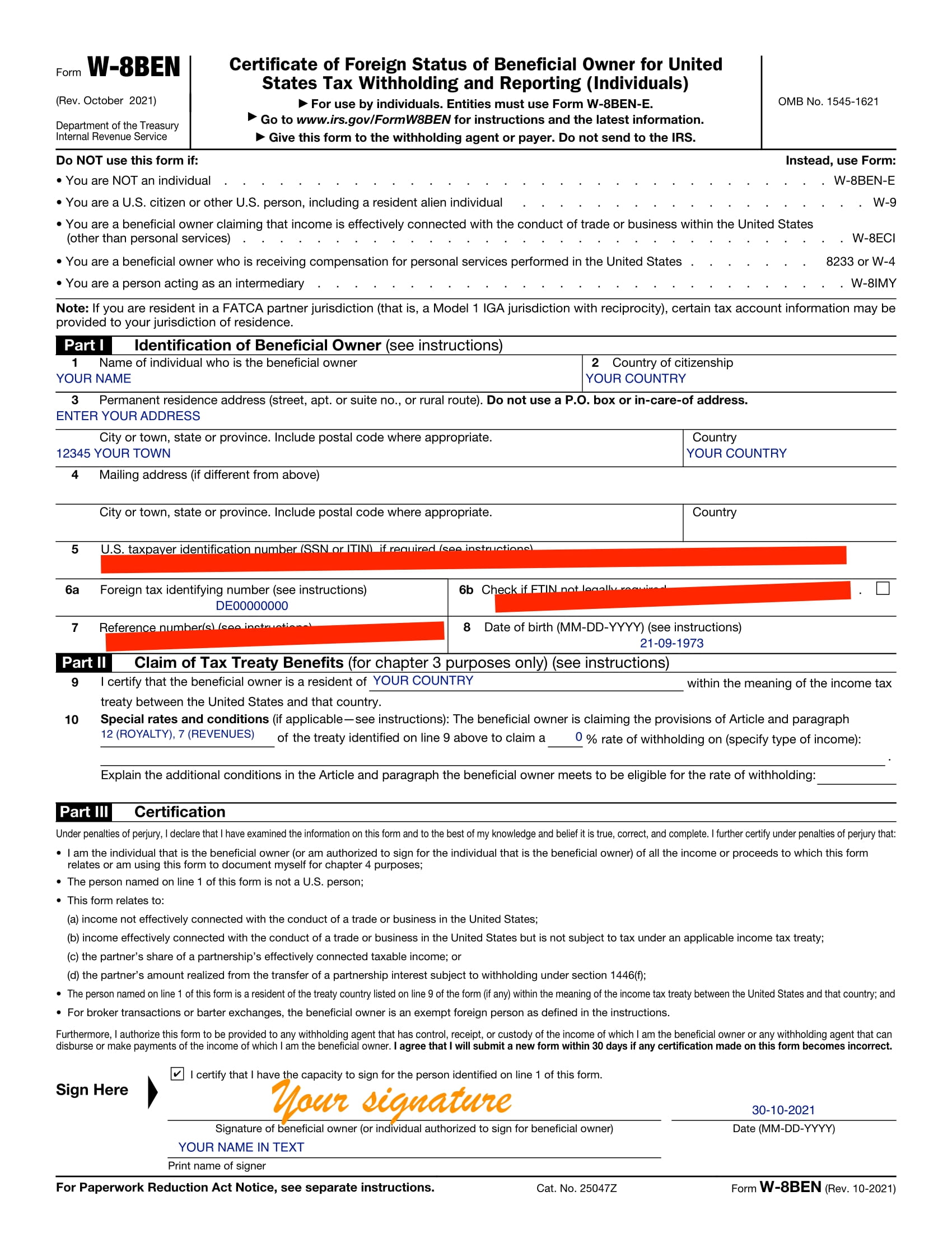

Example of a completed W-8BEN

Download the completed sample W-8BEN form as PDF here

Can I use a digital signature?

No, digital signature may not be used. US law still requires a manual handwritten signature. If you don’t have a printer or scanner, you can take a picture of your signature with your phone against a white background. Then use any image programme and make the white background transparent. Then simply paste the image where you want it to appear in your PDF editor. If your PDF programme does not support the insertion of images, you can convert the form into a Word document with Clever PDF, for example. This way, you can bypass the stone-age rule of manually signing on paper, which then has to be scanned back into the computer.

What income is affected by US tax?

Foreign nationals (as seen by the US) who are non-residents of the US must pay 30% US tax on income they derive from US sources that falls into one or more of these categories:

- Interest (including certain original issue discount (OID))

- Dividends

- Rents

- Royalties

- Premiums

- Annuities

- Compensation for, or in expectation of, services performed

- Substitute payments in a securities lending transaction

- Periodical revenue. Other fixed or determinable annual or periodical gains, profits, or income

Definition of income subject to U.S. withholding tax

More information about W8BEN-E

Additional information from the IRS on W-8BEN(-E) forms in English can be found here