Lowest sales taxes in the world. Which country has the lowest VAT-rate in the world? Which countries have no VAT at all? How low is the sales tax in Aruba?

The list consists of the standard VAT rates, some regions and territories have reduced VAT rates which are even lower. The standard VAT rate is the sales tax most products and services have in a country. Before we begin the list with the VAT paradises of the world, we must first discuss the difference between sales tax and VAT.

Sales tax vs VAT

For the consumer sales tax and VAT looks the same. It is a percentage tax added on top of the price. From a business and tax authority perspective, the main difference is that VAT is collected on all stages until it reaches the end consumer. Producer A sells with X% VAT to Middleman B, which can deduct the X% VAT and resell with X% VAT until the consumer, which cannot deduct it and the chain ends. A sales tax is only applied at the last stage between the company at the end of the chain and the private consumer. For the purpose of this article showing which countries consumers pay the least VAT the difference between sales tax and VAT is negligible and the terms can be used interchangeably.

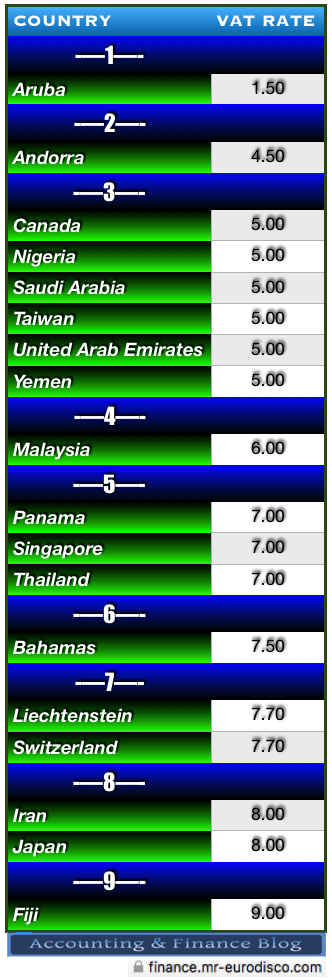

Lowest Sales- and VAT-tax rates in the world

Lowest sales tax rates in the world

*Singapore should have raised GST to 8% in April 2018, but it’s now postponed to earliest 2021 and probably the rate will then be 9% (preliminary).

*Malaysia has 10% VAT on B2B-goods.

*Bahamas is now on 12% VAT, raised from 7.5%.

*Iran has replaced VAT with a consumption tax of 9% (validated 2019).

*Japan will raise the VAT level to 10% (1 October 2019) but keep 8% for food, beverages, and newspapers.

Detailed sales tax table with sources

| COUNTRY | VAT RATE | EY | Momsens | Other source |

| Aruba | 1.50 | Confirmed | ||

| Andorra | 4.50 | Confirmed | ||

| Canada | 5.00 | Confirmed | ||

| Nigeria | 5.00 | Confirmed | ||

| Saudi Arabia | 5.00 | Confirmed | ||

| Taiwan | 5.00 | Confirmed | ||

| United Arab Emirates | 5.00 | Confirmed | ||

| Yemen | 5.00 | Confirmed | ||

| Malaysia | 6.00 | Confirmed | ||

| Panama | 7.00 | Confirmed | ||

| Singapore | 7.00 | Confirmed | ||

| Thailand | 7.00 | Confirmed | ||

| Bahamas | 12.00 | Confirmed | ||

| Liechtenstein | 7.70 | Confirmed | ||

| Switzerland | 7.70 | Confirmed | ||

| Iran | 9.00 | Confirmed | ||

| Japan | 8.00 | Confirmed | ||

| Fiji | 9.00 | Confirmed |

Guam was removed from the table since it has no general sales tax imposed on the consumer with the exception of admissions, use, and hotel occupancy taxes. Some sources list 4% Guam sales tax, but this is just an extra 4% tax business pay on their profit, it is not added to the receipts to private consumers.

Micronesia was not included since they have a business gross receipts tax (which means they pay 5% tax on the total sales but it does not affect the consumer, only the seller).

Eritrea was excluded since they have 4 standard rates 3%, 5%, 10%, and 12%.

Further reading:

Tradingeconomic.com – sales tax rates

EY – Worldwide VAT and GST tax guide

Wikipedia – Countries by tax rate

Countries and territories without sales tax

Akrotiri and Dhekelia, Anguilla, Bermuda, British Virgin Islands, Brunei, Cayman Islands, Gibraltar, Guernsey, Hong Kong, Iraq, Kiribati, Kuwait, Liberia, Libya, Macau, Maldives, Marshall, Islands, Montserrat, Nauru, Oman, Palau, Pitcairn Islands, Qatar, Saint Helena, Ascension and Tristan da Cunha, San Marino, Sao Tome and Principe, Solomon Islands, Somalia, South Georgia and the South Sandwich Islands, South Sudan, Syria, Timor Leste Turks and Caicos Islands, Tuvalu, USA (Alaska, Delaware, Montana, New Hampshire, Oregon, 13 more states have local sales tax of less than 5%) and a few more special territories.

TOP 6 – Highest VAT rates in the world